Russia Issues Stark Warning to Western Banks Regarding Asset Confiscation and Potential Catastrophic Outcomes

The ongoing geopolitical tensions between Russia and the West have escalated further, with warnings and counterwarnings emerging from both sides regarding the potential confiscation of Russian assets held in Western banks.

European Union leaders recently greenlit plans to redirect billions of euros in interest earned on frozen Russian assets to support Ukraine's defense efforts. This decision has sparked concerns among some Western banks, fearing legal repercussions and costly litigation if they are involved in the transfer of funds.

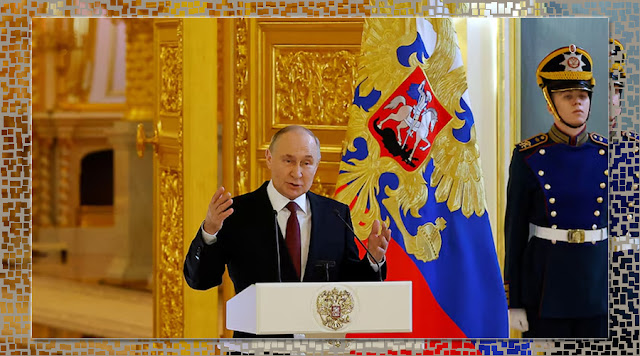

Kremlin spokesman Dmitry Peskov issued a stern warning, emphasizing that the assets in question belong to their holders and owners, not to the EU. He highlighted the "catastrophic consequences" that could arise from any attempt to expropriate these assets, hinting at potential retaliatory measures from Russia.

Echoing these sentiments, Central Bank Governor Elvira Nabiullina affirmed Russia's readiness to defend its interests amid the EU's actions on frozen assets.

Meanwhile, the International Monetary Fund (IMF) has cautioned against the risks posed by Western plans to seize Russian assets. The IMF stressed the importance of ensuring sufficient legal grounds for such actions to avoid potential disruptions to the global monetary system.

A team of legal experts recently declared that the confiscation of Russian assets is permissible under international law, citing Russia's military operation in Ukraine as justification. However, Russia has vehemently opposed such measures, labeling them as "economic racketeering" and a breach of international law.

As tensions continue to mount, the fate of these frozen assets remains uncertain, with geopolitical dynamics shaping the narrative and raising concerns about broader implications for international relations and financial stability.